The 2026 refund season matters more than ever for households managing tight budgets. While the calendar looks familiar, processing now leans heavily on automated checks, data matching, and fraud filters from the Internal Revenue Service. That means accuracy and filing method can influence timing as much as the date you submit.

When Filing Opens

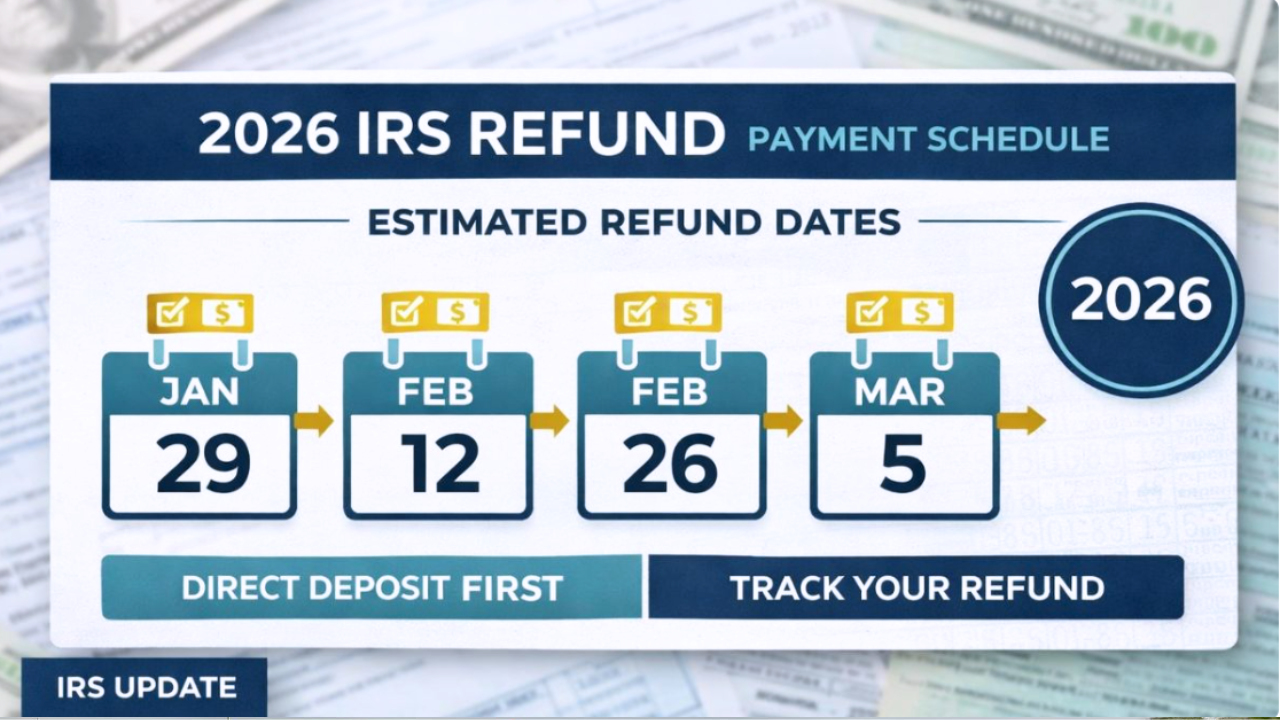

The IRS is expected to start accepting 2025 tax year returns in late January 2026 (often around the last week of the month). Returns sent before opening are held until systems go live. The standard filing deadline is mid-April 2026, with extensions available for paperwork—but not for delaying taxes owed.

How Refund Processing Works

Once filed, your return goes through layered checks:

- Identity and personal data verification

- Income matching against employer and financial reports (W-2, 1099, etc.)

- Review of credits and deductions claimed

E-file + direct deposit typically moves fastest because it avoids manual handling. Paper returns can add weeks due to opening, scanning, and entry.

Typical window (not guaranteed): Many clean e-filed returns with direct deposit are paid within 10–21 days after acceptance. Some are faster; some take longer if flagged.

Estimated Refund Timing by Filing Period

| When You File (E-file, direct deposit, no issues) | Common Refund Window |

|---|---|

| Late Jan (right after opening) | Mid–late February |

| Early February | Late February–early March |

| Mid–late February | Early–mid March |

| March–early April | Mid March–April (varies by volume) |

These are patterns, not promises. Each return is processed individually.

Why Filing Super Early Can Backfire

Submitting before third-party income data is fully posted can cause mismatches that pause your return. Employers and banks transmit statements on their own schedules. A carefully prepared return filed a bit later—after records are available—may move more smoothly than a rushed early one.

Credits That Delay Refund Release

Returns claiming certain refundable credits tied to workers and dependents often face a statutory hold until at least mid-February for fraud screening. Even first-day filers with these credits commonly see deposits in late February or early March. This is normal.

Delivery Method Matters

- Direct deposit: Fastest, most reliable

- Paper check: Slower due to printing and mail

- Prepaid cards/digital options: Faster than mail but review any fees

Common Delay Triggers

- Name/SSN mismatches

- Wrong bank routing/account numbers

- Missing forms or income discrepancies

- Identity verification requests

- Complex returns (multiple jobs, self-employment, amendments)

Practical Tips to Speed Things Up

- E-file and choose direct deposit

- Double-check SSNs, names, and bank info

- Wait until you have all W-2/1099 forms

- Keep documentation for credits/deductions

- Use the official refund tracking tool after filing

Planning Takeaway

Treat refund timing as a window, not a fixed date. Building flexibility into your budget reduces stress if your return lands in a slower review cycle. As employer data fully populates and peak volume passes, processing often becomes steadier.

Disclaimer: General information only. Refund timing varies by individual return and official procedures, which can change. For personal guidance, consult official IRS resources or a qualified tax professional.

Claim Here!

Claim Here!