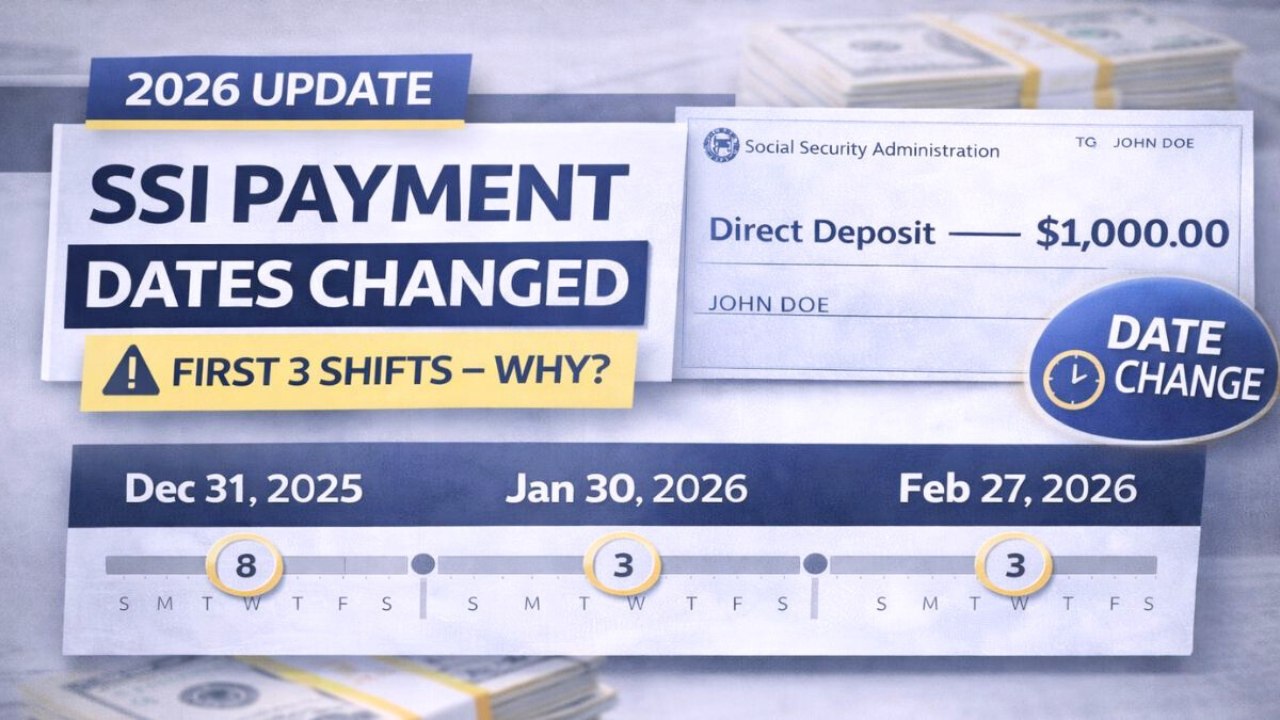

For people who receive Supplemental Security Income (SSI), the payment date each month is critical. These benefits help cover essentials like food, rent, and utilities. Normally, SSI is paid on the first day of each month. But in early 2026, the first three payments didn’t arrive on the usual dates, causing confusion.

The good news: no benefits were cut and no new law caused this. The changes happened because of how the payment calendar works when the first day of the month falls on a weekend or holiday.

The Standard SSI Payment Rule

SSI payments follow one main rule:

If the 1st of the month falls on a weekend or federal holiday, the payment is sent on the last business day before that date.

This prevents delays when banks and government offices are closed. But when several months in a row are affected, it can look unusual — which is exactly what happened at the start of 2026.

January 2026 Payment Shift

January 1 is always a federal holiday (New Year’s Day). Because payments can’t be processed that day, the January 2026 SSI payment was sent on December 31, 2025.

It may have felt like an extra payment, but it was simply January’s benefit paid early.

February and March 2026 Shifts

In 2026:

- February 1 falls on a Sunday

- March 1 also falls on a Sunday

Since Sundays are non-business days, payments were moved to the previous business day.

| Benefit Month | Actual Payment Date |

|---|---|

| February 2026 | January 30, 2026 |

| March 2026 | February 27, 2026 |

Again, these are not extra payments — just early deposits.

Why Some Months Show “Two Payments”

Because of these calendar shifts:

- One month may show two deposits

- The following month may show none

This happens because one payment was moved into the previous month. No money is lost — only the timing changes.

Budgeting Challenges

Early deposits must last longer. For example, when March’s payment arrives in late February, recipients must stretch that money across all of March.

Helpful tips:

- Track the full yearly payment calendar

- Plan spending based on when funds arrive, not just the month label

- Avoid assuming a double deposit means extra income

SSI Benefit Amounts for 2026

SSI payments also increased due to a cost-of-living adjustment (COLA).

| Category | Maximum Monthly Amount |

|---|---|

| Individual | $994 |

| Eligible couple | $1,491 |

| Essential person | $498 |

Not everyone receives the maximum. Payments depend on income and eligibility. Some states add extra supplements.

No Benefits Are Lost

The total yearly benefit amount does not change. The system simply shifts dates to avoid weekends and holidays. Understanding this prevents unnecessary worry and misinformation.

FAQs

Did SSI benefits get reduced in 2026?

No, only payment dates shifted.

Did I receive an extra payment in December?

No, that was January’s benefit paid early.

Why does my account show two payments in one month?

One is an early payment for the following month.

Will this happen again?

Yes, whenever the 1st falls on a weekend or holiday.

How can I plan better?

Use the full yearly SSI calendar instead of monthly assumptions.

Conclusion

The early 2026 SSI date changes were caused entirely by weekends and a federal holiday. While the schedule looked unusual, recipients still receive the same total benefits. Knowing how the calendar rules work helps reduce stress and makes budgeting easier.

Disclaimer: This information is for general educational purposes and not official government guidance. Always verify payment details through the Social Security Administration.

Claim Here!

Claim Here!