The 2026 tax season is moving quickly, and many Americans are watching closely for their refunds. For millions, a refund is more than extra cash — it helps cover rent, food, bills, and savings goals. February is one of the most important months for refund payments, especially for early filers.

Why February Is a Key Refund Month

The Internal Revenue Service (IRS) typically sends a large wave of refunds in February. Taxpayers who file early — including salaried workers and retirees with simple tax situations — are often among the first to receive money.

Many families file early because they want faster access to funds. Historically, a high volume of refunds is issued between mid- and late February.

How Refund Processing Works

After an electronic return is accepted, it goes through automated checks that:

- Verify income details

- Confirm tax credits

- Compare withholding amounts

If everything matches records, the refund moves forward for payment.

E-filing + direct deposit is the fastest method. Paper returns take longer because they require manual handling.

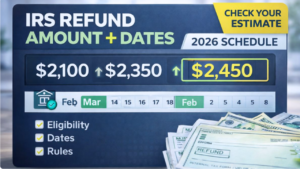

Estimated February 2026 Refund Timeline

| Filing Time | Expected Refund Window |

|---|---|

| Late January e-filers | Early to mid-February |

| Early February filers | Mid to late February |

| Returns needing review | Late February to early March |

Most electronic refunds are completed within two to three weeks if no issues are found.

Common Causes of Refund Delays

Refunds may be delayed due to:

- Incorrect bank account numbers

- Name or Social Security number mismatches

- Math errors or missing entries

- Identity verification requests

- Amended or unusual tax situations

Submitting a second return because of worry can slow things further. It’s better to wait and track status.

What Tax Professionals Are Seeing

Tax experts report that clean, accurate e-filed returns are processing smoothly. However, returns with unusual claims or discrepancies are being reviewed more carefully as part of fraud prevention.

Double-checking entries before filing remains one of the best ways to avoid delays.

How Refund Timing Affects Families

February refunds often help families:

- Catch up on winter bills

- Pay down debt

- Build emergency savings

Delays can force households to rely on borrowing, increasing financial stress.

Economic Impact of February Refunds

Refunds also benefit local economies. Money spent on essentials, repairs, and services supports small businesses. Large delays across many taxpayers can slow local economic activity.

How to Track Your Refund

Taxpayers can safely track refunds using official IRS tools. These show:

- Return received

- Processing status

- Approval

- Payment sent

Updates may not appear daily, but these tools are the most reliable source.

What Happens After February

Refunds continue through March and later for:

- Later filers

- Returns needing review

- Identity verification cases

Responding quickly to official notices helps keep refunds on track.

FAQs

How fast are refunds issued in February?

Often within 2–3 weeks for e-filed returns.

Does direct deposit speed things up?

Yes, it’s much faster than paper checks.

Why is my refund delayed?

Errors, identity checks, or data mismatches.

Should I refile if it’s slow?

No, that can cause more delay.

Are February refunds common?

Yes, it’s one of the busiest refund periods.

Conclusion

February remains a major refund month in the 2026 tax season. Filing electronically, using direct deposit, and ensuring accuracy are the best ways to receive funds quickly. While most refunds follow a two-to-three-week timeline, some may take longer due to review processes.

Disclaimer: This article is for general information only and not tax advice. Refund timing varies based on individual situations. Always verify details through official IRS resources or consult a tax professional.

Claim Here!

Claim Here!