As the 2026 tax filing season gets underway, many taxpayers are eager to know when their federal income tax refunds will arrive. February is one of the busiest months for refund activity, since a large number of returns are filed early. Understanding how the process works — and what affects timing — can help you plan your finances with confidence.

How the IRS Processes Tax Refunds

When you submit your federal income tax return, here’s how the refund process generally works:

- Return Submitted: Once the IRS receives your tax return electronically (e-file), processing typically begins within a few business days.

- Review & Validation: Your return is reviewed for errors, missing information, or issues that may trigger further review.

- Refund Issued: For most accurate e-filed returns with direct deposit, the IRS aims to issue refunds within about 21 days.

Key Point:

- Direct deposit is the fastest refund method.

- Paper returns take significantly longer — often 6–8 weeks or more — because manual handling is required.

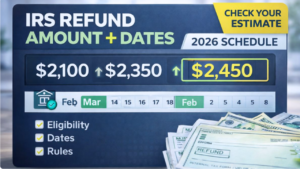

Expected Refund Timing in February 2026

If you file early (late January or early February) and choose direct deposit, many taxpayers can expect refunds in February 2026.

- Early Filers: Refunds may arrive in the first half of the month.

- Later Filers: Refunds could come toward the end of February.

- Credits Involved: Returns claiming credits such as the Child Tax Credit or Earned Income Tax Credit (EITC) may take longer, due to required additional verification.

Keep in mind that the 21-day IRS guideline is an estimate — not a guarantee — and individual cases vary.

Common Reasons Refunds Are Delayed

Not all refunds arrive on schedule. Several things can slow processing:

- Calculation Errors: Simple math errors can trigger manual reviews.

- Missing or Incorrect Information: Wrong Social Security numbers or bank routing numbers can hold up refunds.

- Identity Verification: The IRS may contact you to confirm your identity.

- Refundable Credits: Claims for certain credits often require extra time for verification.

- Mismatched Records: Income reported on W-2s or 1099s must match IRS records.

Even minor mistakes can cause delays, so double-checking your data before filing can help speed things up.

How to Track Your Refund Status

Once the IRS accepts your return, you can track your refund:

- IRS “Where’s My Refund?” Tool: Use this official online tool to check your status in real time.

- Mobile App: The IRS2Go app also provides status updates.

- Status Terms: You’ll typically see status updates like Received, Approved, and Sent.

After the IRS issues a refund, your bank’s processing time may add an extra day or two before funds appear in your account.

Tips to Help Your Refund Arrive Faster

Here are practical steps to improve your timeline:

- E-file your return instead of paper filing.

- Choose direct deposit for your refund.

- Verify all entries before submitting (especially Social Security and bank info).

- Respond promptly if the IRS asks for identity or document verification.

Being proactive can reduce common delays and put your refund in reach sooner.

FAQs — February 2026 IRS Refund Timeline

Q: When will refunds start arriving in February 2026?

A: Early refunds for e-filed returns with direct deposit can begin arriving in the first half of February, depending on when the return was accepted.

Q: Why do some refunds take longer than 21 days?

A: Additional verification (for credits, identity, or errors) and high IRS workload can extend processing time.

Q: Can I track my refund online?

A: Yes. Use the IRS “Where’s My Refund?” tool or the IRS2Go app for updates.

Q: Is paper filing slower than e-filing?

A: Yes. Paper returns require manual processing and can take weeks longer.

Q: Does bank processing affect refund timing?

A: Yes. After the IRS issues your refund, your bank may take 1–2 days to post the deposit.

Final Note

Filing early, choosing direct deposit, and entering accurate information remain your best strategies for receiving a refund quickly in February 2026. While most taxpayers see refunds within around three weeks, timelines can vary based on individual circumstances and IRS processing conditions.

For the most accurate and personalized refund information, always verify your status directly through official IRS tools.

This article is intended for general informational purposes only. Refund timelines are estimates and may change due to IRS processes or individual return details.

Claim Here!

Claim Here!