As the 2026 tax season approaches, many Americans are asking the same question: When will my tax refund arrive? For millions of households, a refund helps cover bills, reduce debt, or rebuild savings. While the Internal Revenue Service does not release exact payment dates for individuals, past processing patterns offer useful guidance.

Understanding how refunds are processed can help you plan your finances with less uncertainty.

How the Tax Refund Process Begins

After you submit your federal return, the IRS system moves through several steps before releasing a refund.

Main stages include:

- Return acceptance

- Income verification with W-2 and 1099 records

- Credit and deduction review

- Error checks and fraud screening

If everything matches official records, your refund moves toward approval. If something appears incorrect or incomplete, processing may pause for review.

Why Filing Method Matters

How you file your return plays a major role in how fast you receive your money.

Faster option

Electronic filing (e-file) sends your return directly into IRS systems, reducing manual work and errors.

Slower option

Paper filing requires physical handling, data entry, and mailing time, which can add weeks to processing.

Taxpayers seeking quicker refunds usually benefit from filing electronically.

Direct Deposit vs. Paper Check

Choosing how you receive your refund is just as important as how you file.

| Payment Method | Speed | Risk Level |

|---|---|---|

| Direct Deposit | Fastest | Low |

| Paper Check | Slower | Mail delays possible |

Direct deposit sends funds straight to your bank once approved, often saving days or weeks.

Expected Start of the 2026 Filing Season

Based on recent trends, tax filing for the 2025 tax year is expected to open in late January 2026. Early filers with simple returns and direct deposit often receive refunds within about 2–3 weeks after acceptance.

Filing early places your return earlier in the processing line, but accuracy is still more important than speed.

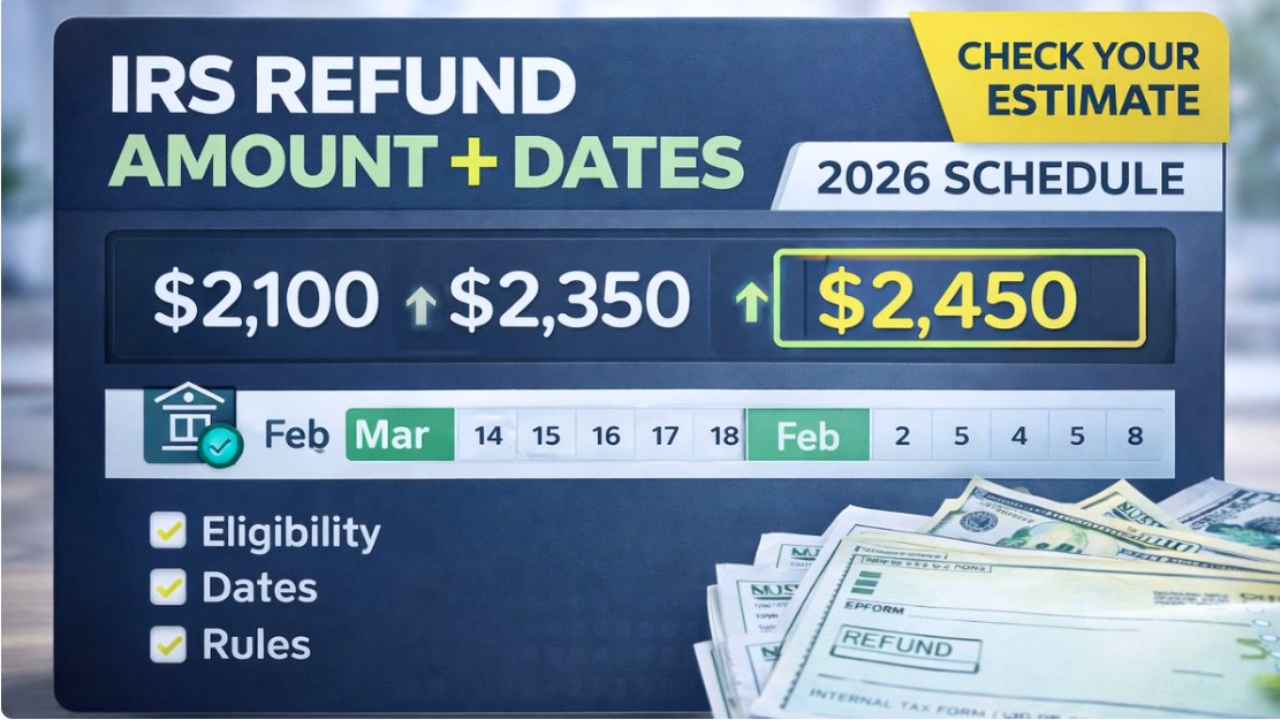

Estimated Refund Timing by Filing Period

Although not guaranteed, general patterns look like this:

| Filing Timeframe | Possible Refund Window |

|---|---|

| Late January | Mid to late February |

| Early February | Late February to early March |

| Late February | March |

| March | Late March to April |

Processing volume and verification needs can change timelines.

Credits That Can Delay Refunds

Certain tax credits may legally delay payment release.

Common examples:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

Returns claiming these credits may not be fully released until at least mid-February, even if filed early.

Other delay causes include identity verification, missing forms, or mismatched records.

How to Track Your Refund Safely

The IRS provides official tracking tools that show refund status stages such as:

- Received

- Approved

- Sent

You typically need your Social Security number, filing status, and expected refund amount to check progress.

Official IRS tools provide the most reliable information.

Tips for Faster Refund Processing

To reduce delays:

- File electronically

- Choose direct deposit

- Double-check names, numbers, and bank details

- Include all income forms

- Avoid filing duplicate returns

Accuracy prevents many common slowdowns.

FAQs

1. When do most 2026 refunds arrive?

Most are expected between February and April, depending on filing date and review needs.

2. What is the fastest way to receive a refund?

Electronic filing with direct deposit.

3. Why is my refund delayed?

Possible reasons include errors, identity checks, or credit-related review rules.

4. Can I get an exact refund date?

No. Each return is processed individually.

5. Should I rely on refund calendars online?

Only official IRS tools provide accurate status for your specific return.

Conclusion

While there is no universal refund calendar, most 2026 tax refunds will follow familiar processing patterns. Filing electronically, choosing direct deposit, and submitting an accurate return give you the best chance of receiving your money quickly. Staying informed and using official tracking tools helps you plan with confidence and avoid unnecessary stress.

Claim Here!

Claim Here!