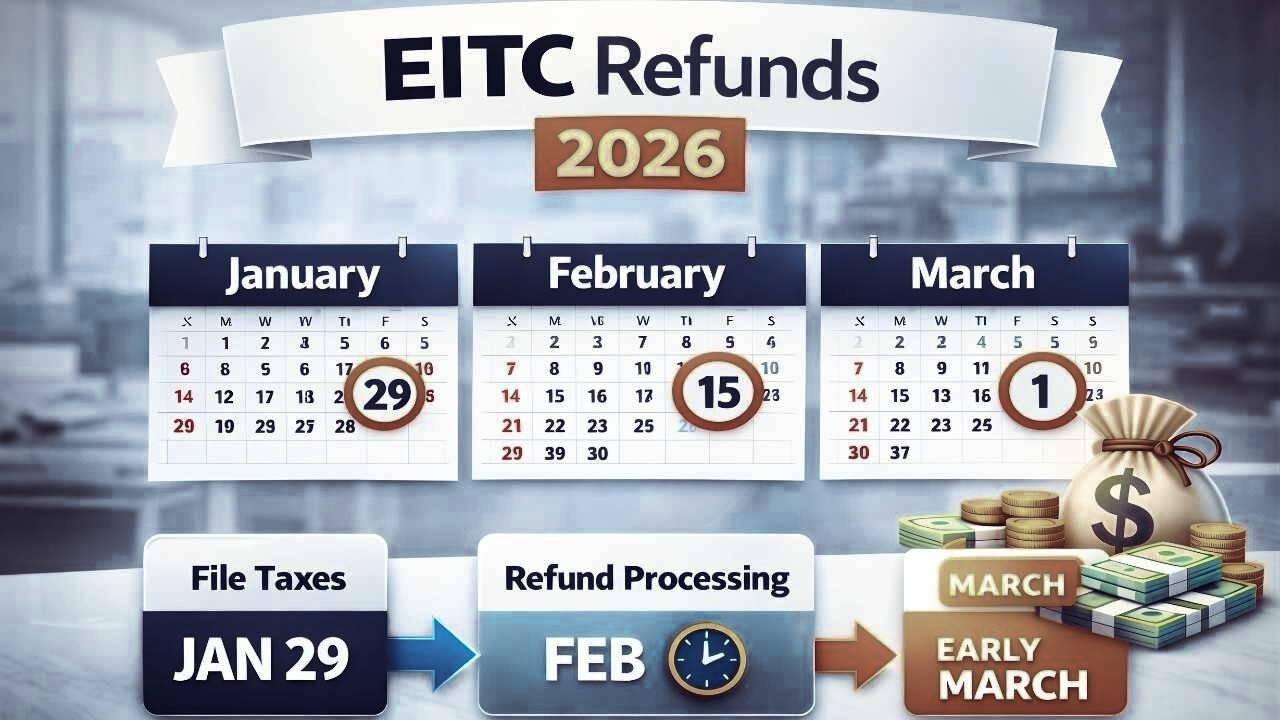

Millions of workers claiming the Earned Income Tax Credit (EITC) should expect refund delays during the 2026 tax season. Even if you file early and everything is correct, your refund may not arrive until late February or early March. This delay is required by law and is designed to prevent fraud—not a mistake by the IRS.

Understanding the timeline helps families budget smarter and avoid unnecessary worry.

Why EITC Refunds Are Delayed

The PATH Act Rule

The delay comes from the Protecting Americans from Tax Hikes Act of 2015 (PATH Act). This law requires the Internal Revenue Service to hold refunds that include:

- Earned Income Tax Credit (EITC)

- Additional Child Tax Credit (ACTC)

Key rule:

No refunds containing these credits can be issued before mid-February, even for early filers.

When Tax Returns Began Processing

The IRS started accepting 2025 tax returns in late January 2026. While most taxpayers receive refunds within about 21 days, EITC filers go through extra checks.

Additional IRS Reviews Include

- Confirming income with employer records

- Verifying dependents

- Identity checks

- Comparing with prior-year returns

These steps reduce identity theft and fraudulent claims.

Expected Refund Dates

| Filing Method | Estimated Refund Window |

|---|---|

| E-file + Direct Deposit | Late February to early March |

| Paper Return | Early to mid-March |

| Paper Check Delivery | Add 1–2 weeks mailing time |

Many eligible taxpayers see deposits during the first week of March.

How to Track Your Refund

Use official IRS tools:

- “Where’s My Refund” online tool

- IRS2Go mobile app

These provide real-time status updates once processing begins. Checking multiple times per day won’t speed up results.

Tips to Avoid Extra Delays

Small errors can push refunds back weeks. To keep things moving:

- File electronically

- Choose direct deposit

- Double-check Social Security numbers

- Confirm income matches W-2 or 1099 forms

- Enter correct bank routing and account numbers

- Use trusted tax software or IRS Free File

- Respond quickly to IRS letters

Accuracy matters more than speed.

Why the Delay Actually Helps Taxpayers

The EITC is one of the largest support programs for working families. Because refunds can be substantial, criminals often attempt fraud using stolen identities. The review period:

- Protects taxpayers from identity theft

- Ensures refunds go to the right person

- Prevents payment errors

Though waiting is frustrating, the system improves overall security.

Quick Summary

- EITC refunds cannot be issued before mid-February

- Most eligible taxpayers receive money late Feb–early March

- Direct deposit is faster than checks

- Extra verification is legally required

FAQs

1. Is my refund delayed because I made a mistake?

Not necessarily. All EITC refunds are held until mid-February.

2. Can calling the IRS speed things up?

No. The timeline is set by law.

3. What if my refund still hasn’t arrived by mid-March?

Check the refund tool or look for IRS notices requesting information.

4. Does direct deposit help?

Yes, it’s the fastest way to receive funds.

5. Are all refunds delayed?

No, only those including EITC or ACTC.

Final Thoughts

If you claimed the EITC, waiting until March for your refund is normal in 2026. Filing accurately, using direct deposit, and tracking your return through official tools will help you stay informed. Planning ahead for the delay can reduce financial stress and keep expectations realistic.

Claim Here!

Claim Here!