Online discussions about a $2,000 federal direct deposit for all Americans have gained attention in early 2026. The idea is tied to inflation relief and household affordability concerns. However, it is important to be clear: this payment is a proposal, not an approved program.

Here’s a straightforward breakdown of what is being discussed, how such payments would work if passed, and what Americans should watch for.

Why a $2,000 Payment Is Being Discussed

Lawmakers and policy groups have raised the idea due to:

- Rising housing and grocery costs

- Utility and insurance price increases

- Slower wage growth

- Higher household debt

Supporters argue a flat payment offers fast relief and boosts consumer spending. Critics question inflation risks and federal budget impact.

Legislative Status

Any national payment would require:

- Approval by U.S. Congress

- Implementation through the U.S. Department of the Treasury

- Distribution by the Internal Revenue Service (IRS)

As of now:

- No final bill has been enacted

- Discussions and draft proposals exist

- No payment schedule is guaranteed

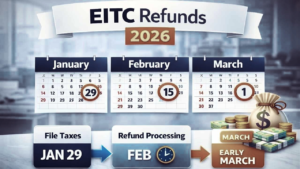

Possible February 2026 Timeline (If Approved)

| Phase | Potential Timing | What Happens |

|---|---|---|

| Bill approval | Late Jan–Early Feb | Law signed |

| Agency setup | 1–2 weeks later | Systems updated |

| Direct deposits | Mid–Late Feb | Bank payments begin |

| Paper checks | Late Feb–March | Mailed to others |

This is hypothetical and depends entirely on legislation.

Who Might Qualify

While final rules are unknown, past federal payments suggest likely conditions:

| Criteria | Description |

|---|---|

| Citizenship | U.S. citizens or legal residents |

| SSN | Valid Social Security number |

| Tax Filing | Recent tax return or federal benefit record |

| Dependents | May affect eligibility |

| Income Limits | Phase-outs above set thresholds |

Income caps could vary by filing status (single, married, head of household).

How Payments Would Be Sent

Direct Deposit

Fastest method using IRS or SSA bank details already on file.

Paper Checks

Mailed to last known address; slower delivery.

Prepaid Debit Cards

Possible for unbanked recipients.

Tax and Benefit Impact

Most proposals suggest:

- Payment not taxable

- No effect on tax refunds

- No reduction in Social Security benefits

- Temporary exclusion from SSI, SNAP, Medicaid calculations

Final treatment would depend on law wording.

How to Prepare

Even without approval, useful steps include:

- File recent tax returns

- Update direct deposit details

- Confirm mailing address

- Use official government sources for updates

Avoid Misinformation

Be cautious of:

- Claims payments are already guaranteed

- Messages requesting fees

- Emails/texts asking for personal data

Federal agencies do not charge fees for relief payments.

FAQs

Is the $2,000 payment confirmed?

No, it remains a legislative proposal.

Would everyone get the full amount?

Possibly not—income limits may apply.

Do people need to apply?

Likely automatic if approved.

Is it taxable?

Most proposals say no.

Are seniors eligible?

Many proposals include Social Security and disability beneficiaries.

Final Outlook

The $2,000 federal direct deposit concept reflects ongoing economic concerns, but it is not yet law. Any real payment would require congressional approval and official announcements from federal agencies. Until then, Americans should treat online claims cautiously and rely on verified government information.

Claim Here!

Claim Here!