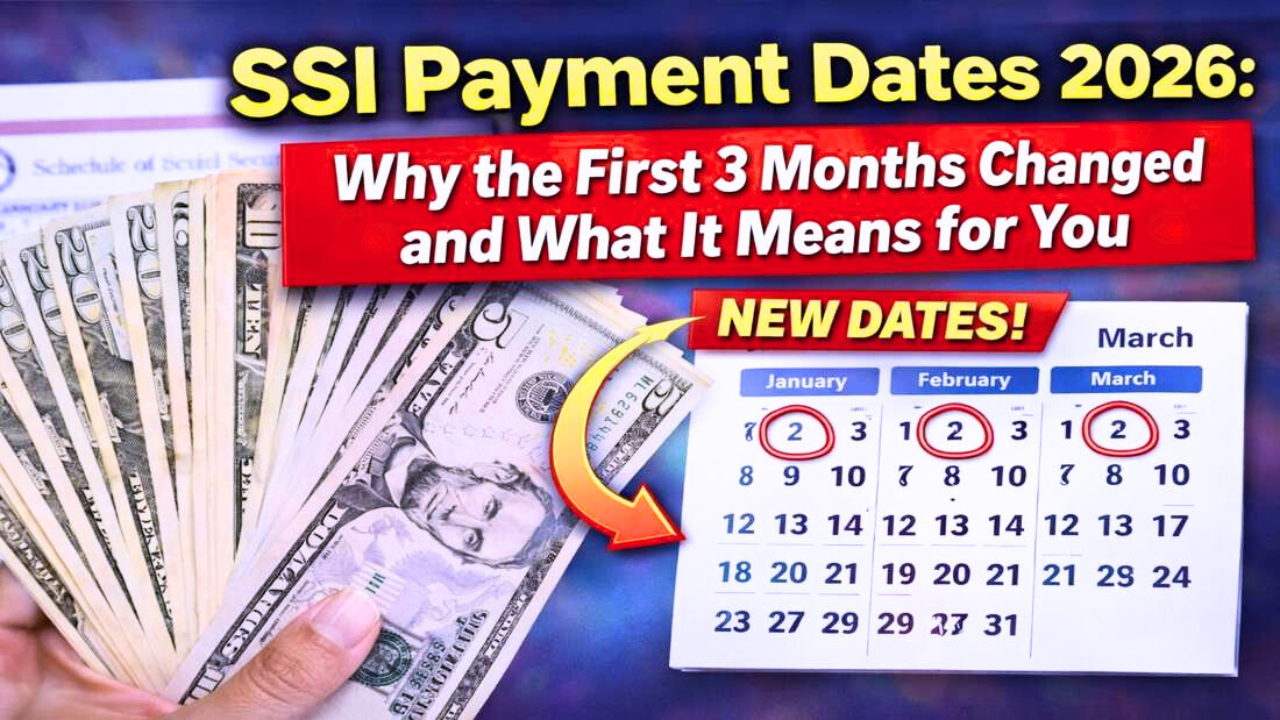

At the start of 2026, many Supplemental Security Income (SSI) recipients noticed something unusual. Their payments did not arrive on the usual first-of-the-month schedule. For households that depend on SSI to cover rent, food, and utilities, even a small change in timing can cause confusion.

The good news is that no benefits were reduced or removed. The date changes were simply the result of how the official payment calendar works under rules set by the Social Security Administration.

Here is what happened.

The Standard SSI Payment Rule

SSI is normally paid on the first day of each month.

However, there is an important scheduling rule:

- If the first falls on a weekend, payment is sent on the previous business day.

- If the first falls on a federal holiday, payment is also moved to the last business day before the holiday.

This ensures recipients receive funds before banks and government offices close.

What Happened in January 2026

January 1 is always a federal holiday (New Year’s Day).

Because banks and federal offices are closed on that day:

- The January 2026 SSI payment was issued on December 31, 2025.

- This was not an extra payment.

- It was simply January’s benefit sent one day early.

Some recipients mistakenly thought they received a bonus payment, but it was only a schedule adjustment.

Why February and March Payments Also Shifted

The pattern continued due to weekend timing.

In 2026:

- February 1 falls on a Sunday

- March 1 also falls on a Sunday

Because Sundays are not business days:

- The February payment was sent on Friday, January 30, 2026

- The March payment was sent on Friday, February 27, 2026

Again, these were early deposits — not additional payments.

Why Some Months Show Two Payments

Calendar shifts can create confusion.

How It Looks in Your Bank Account

| Month | What You May See |

|---|---|

| January | Two deposits (Jan + early Feb) |

| February | Two deposits (Feb + early Mar) |

| March | No deposit at the start of the month |

When payments move backward, one month may appear to have two deposits, while the following month appears to have none.

But over the full year:

- You still receive 12 payments.

- Your total yearly benefit remains the same.

Budgeting Challenges for SSI Recipients

Early deposits can create planning difficulties.

When a payment arrives at the end of the previous month, it must stretch longer than usual. For example:

- A February 27 deposit must last through all of March.

- Without careful budgeting, funds may run out early.

Helpful Planning Tips

- Review the full annual SSI payment calendar.

- Track deposit dates ahead of time.

- Treat early deposits as next month’s income.

- Create a monthly spending plan.

Looking at the entire year helps avoid confusion month to month.

Updated SSI Maximum Payment Amounts for 2026

SSI benefit amounts increased due to the annual cost-of-living adjustment (COLA).

2026 Federal Maximums

- Individual: $994 per month

- Eligible couple: $1,491 per month

- Essential person: $498 per month

These are maximum federal amounts. Actual payments may be lower depending on:

- Countable income

- Living arrangements

- State supplements

Some states add additional payments on top of the federal amount.

No Benefits Are Lost Due to Date Changes

This is the most important point.

- No SSI payments were canceled.

- No benefits were reduced.

- Only the timing changed.

The system is designed to prevent delays when the first of the month falls on a non-business day.

Frequently Asked Questions

1. Did SSI recipients receive extra payments in early 2026?

No. Payments were simply issued earlier due to weekends and holidays.

2. Why did January’s payment arrive in December?

January 1 is a federal holiday, so payment was sent on the previous business day.

3. Will this happen again later in 2026?

Yes. Anytime the first falls on a weekend or holiday, payments shift.

4. Are total yearly benefits affected?

No. The total annual amount remains the same.

5. Where can I verify payment dates?

Check official schedules from the Social Security Administration.

Final Thoughts

The early 2026 SSI payment shifts were caused entirely by calendar timing — not by new laws or benefit cuts. While the adjusted schedule may look unusual, recipients are still receiving the full amount they are entitled to.

Understanding how the payment calendar works can reduce stress and make budgeting easier throughout the year.

Claim Here!

Claim Here!